LEO Weekly Recap | LEO to $10B, Perps Launch and sLEO USDC Rewards

The LEO Ecosystem is SURGing forward in more ways than one. With updates happening across the board with our various dev teams, we've had an action-packed week. Let's dive right in!

🦁 LEO to $10B? Our 10yr Master Plan for LEO 🏦 LeoDex Perpetual Futures, Powered Exclusively by Rujira Network 💰 sLEO USDC Rewards Begin on September 23rd 🔂 POL Perma-Staked Autocompounding Treasury is Growing 🌊 LeoStrategy Generates a 507% LEO Yield

LEO to $10B? Our 10yr Master Plan for LEO

Khal published a blog post this morning outlining his Master Plan for taking the LEO Token Ecosystem to $10B by 2035. In his post, he talks about the $10B Market Cap target for the LEO Token Economy by 2035 and the 4 pillars that are needed to achieve it.

- LEO Market Cap to $10B ($350+ LEO)

- LeoDex to $1B/Year In DEX Volume

- LeoMerchants to $1B/Year in Payments

- LeoPremium to 10,000 Subscribers

- LeoAI to 100,000 Agents

Read the full post here.

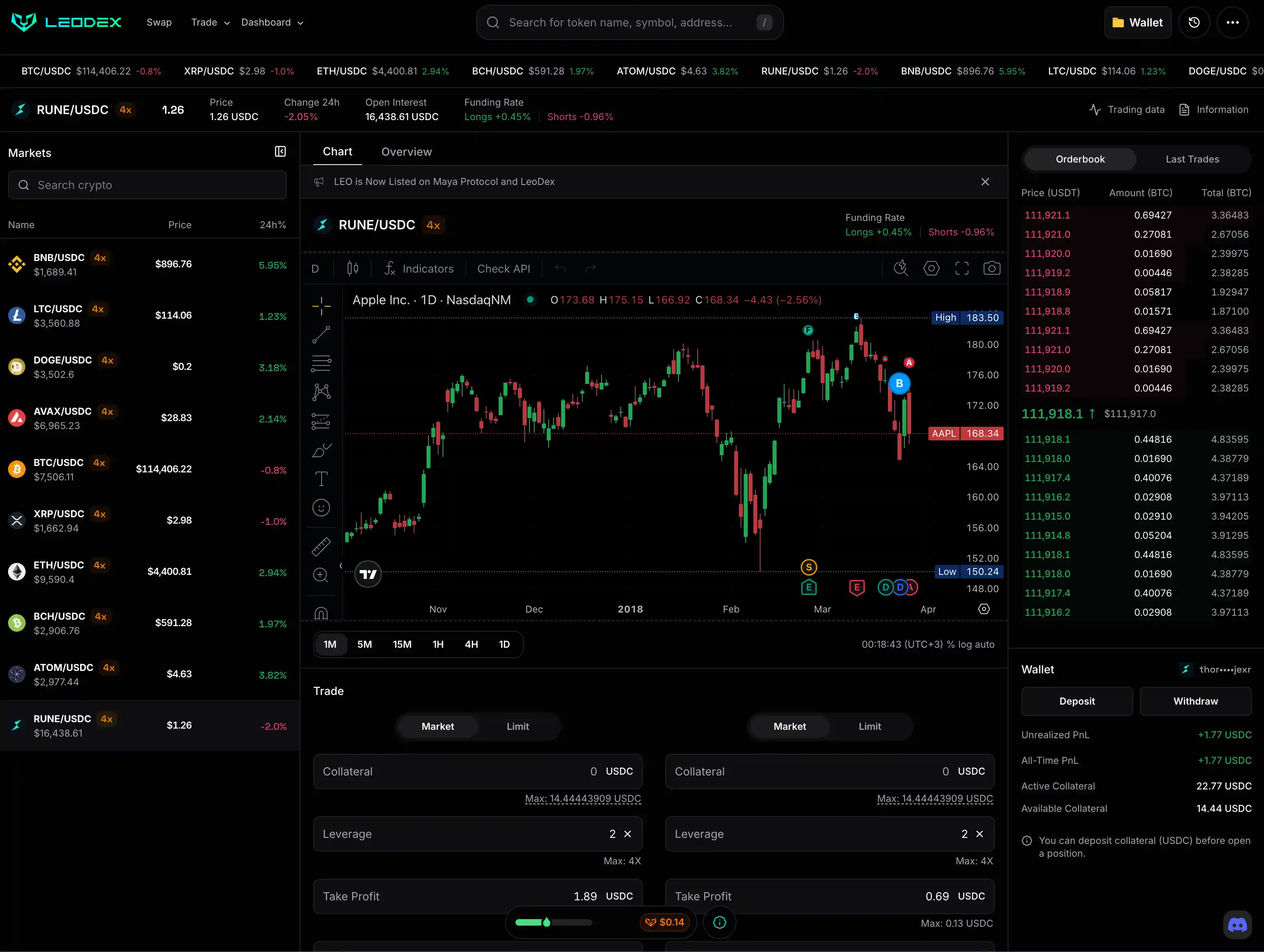

LeoDex Perpetual Futures, Powered Exclusively by Rujira Network

Perpetual Futures (Perps) have become the biggest trading market in the entire crypto landscape. The rapid rise and success of Hyperliquid has shown that Decentralized Perps are the next big thing in the crypto DeFi market.

LeoDex is integrating Rujira Network's Perps market exclusively. We are the first interface to have their perps live and what the team has cooked up is a thing of beauty. The UI feels like you are on your favorite CEX but its fully decentralized and operating as a simple interface to the backend of Rujira.

The community is rallying behind our launch and things are about to take off. Join for the AMA today to get an exclusive look at what's coming.

sLEO Rewards Begin on September 23rd!

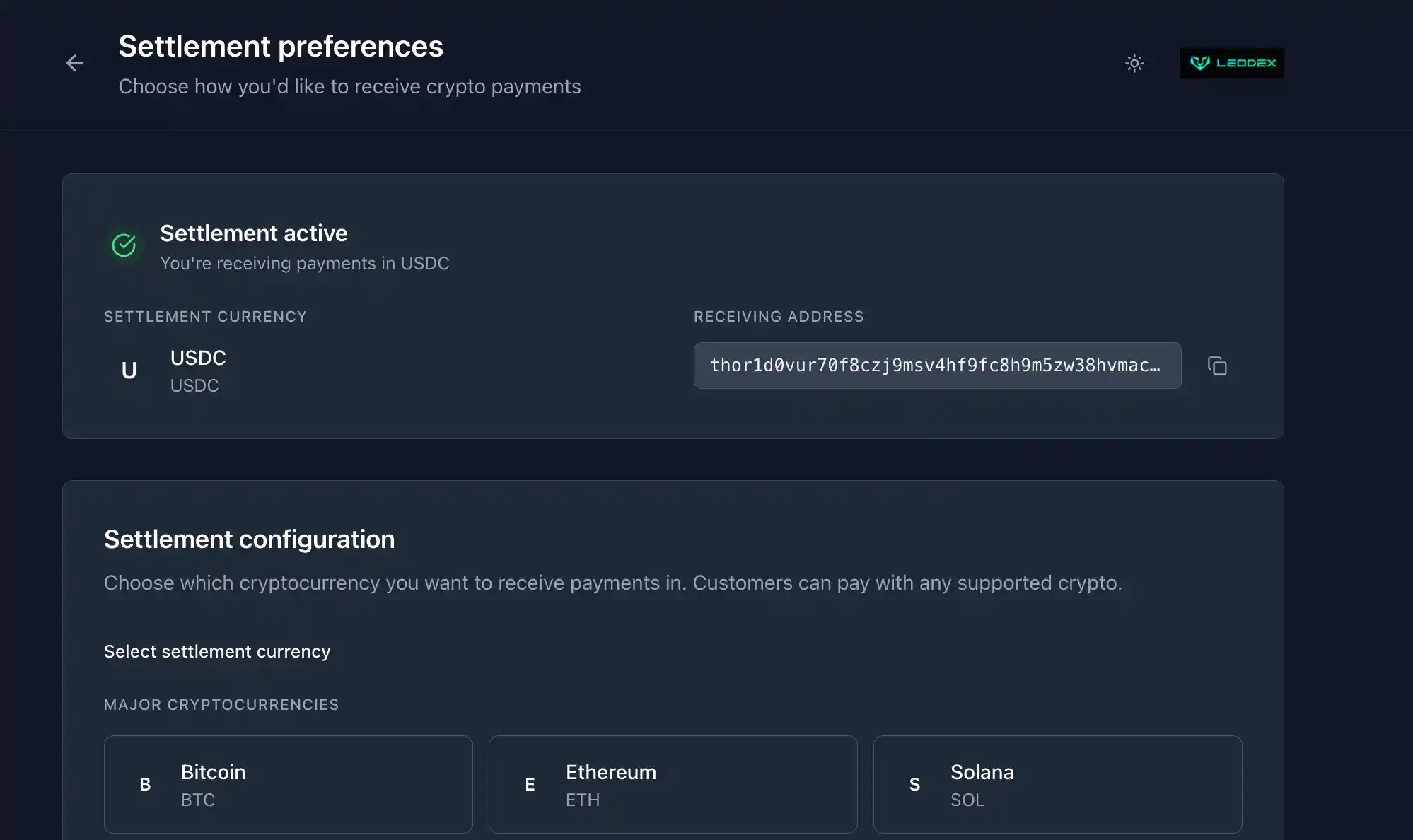

Staked LEO (sLEO) rewards will start on September 23rd. That is next week! 90 days flew by like it was nothing. 100% of LeoDex Affiliate Rewards are paid directly into the sLEO Contract. These rewards can then be harvested by active sLEO Stakers every 24 hours. Learn more and stake your LEO so that you're ready for the 9/23 launch of rewards -> https://leodex.io/leo.

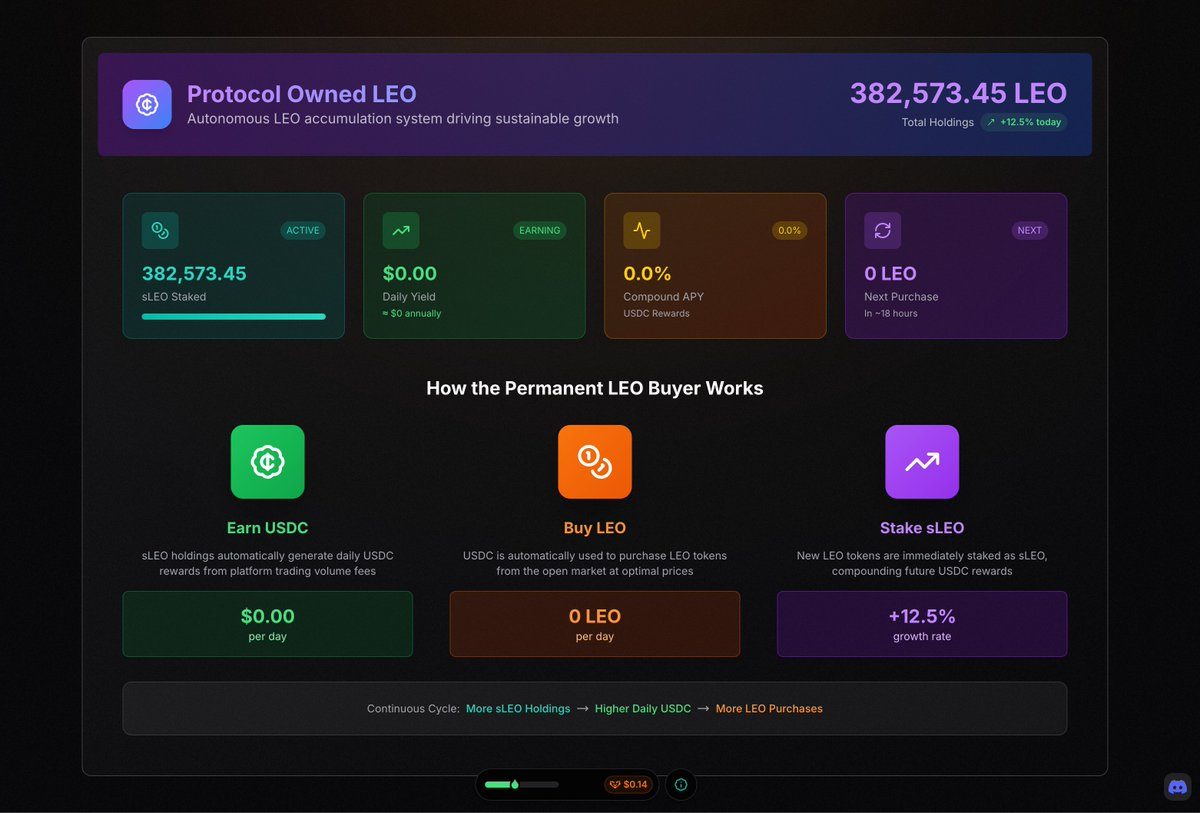

Protocol Owned LEO (PoL) Continues to Grow

ICYMI: POL is currently using 100% of LeoDex affiliate revenue to buyback LEO and perma-stake it in the POL Treasury Address

This address can never unstake/sell its sLEO

Once USDC Rewards start on 9/23, 100% of LeoDex affiliate fees get paid to the sLEO contract (instead of the POL Address directly).

From 9/23 onward, the POL address will autocompound its portion of USDC rewards into daily LEO purchases. Growing the sLEO perma-stake it owns and adding continual buy pressure to the LEO Economy

You can track the POL Address and its daily growth on the LEO Page -> https://leodex.io/leo

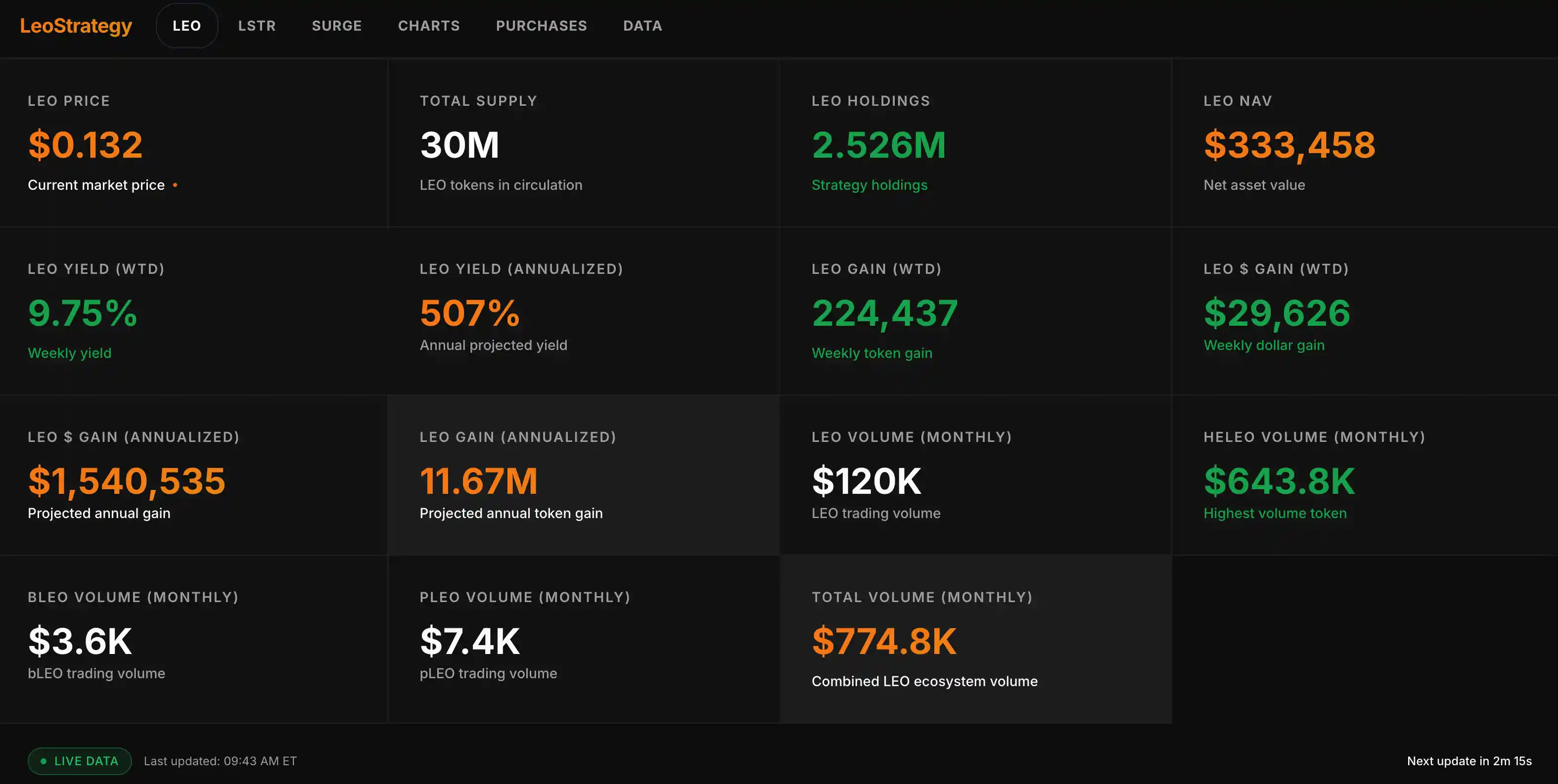

LeoStrategy Generates a 507% LEO Yield

LeoStrategy is a community-created version of Microstrategy with a very similar mission: generate accretive LEO Yield to all LSTR token holders by raising capital and purchasing LEO

LeoStrategy permanently stakes their LEO as sLEO and as a multi-sig mandate, it can never sell its LEO. The sLEO it owns operates similarly to POL -> it autocompounds 100% of its USDC earnings (starting September 23rd) into more daily LEO buys

LeoStrategy acquired an additional 224,436.87 LEO in the past 7 days and now owns over 2.5M LEO

Their current offering is called "SURGE" and offers a fixed yield instrument that pays stablecoin yield (15% APR) to holders on the Hive and Base blockchains as HBD or USDC. This offering is now ~52% committed and is looking to be oversubscribed in the coming days/weeks with 100% of the proceeds being used to fund their LEO Purchases.

LeoStrategy aims to be different than traditional Strategy companies like Microstrategy by engineering volatility and actually harvesting it using Market Makers.

With the unique setup of being onchain and having a moat around bridging fees, LeoStrategy can sustainably market make LEO, LSTR and any LSTR-Derivatives (like SURGE) to generate profits. These profits are then used to buy LEO and expand their balance sheet which enables their flywheel to raise more capital and acquire more LEO.

It's a fascinating experiment in financial engineering and a big group of LEO Holders and community members operate the project as essentially a DAO on top of LEO.

Read more in their two latest blog posts:

- https://inleo.io/@leostrategy/how-leostrategy-engineers-volatility-to-create-profits-buy-more-leo-cts?referral=leostrategy

- https://inleo.io/@leostrategy/leostrategy-has-acquired-an-additional-22443687-leo-for-2818442-usd-507-yield-for-lstr-holders-adu?referral=leostrategy

Join Us for the Weekly LEO AMA!

The weekly LEO AMA goes live 53 minutes from when we publish this blog post. Every week at Noon EST, our community meets for a live AMA where we share all the happenings in the LeoVerse + answer your questions live onchain and in the broadcast.

Set reminders and join us on X Spaces, YouTube Live and Threadcast -> https://x.com/khalkaz/status/1967646862359560311.

Posted Using INLEO